Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

| |

|  |

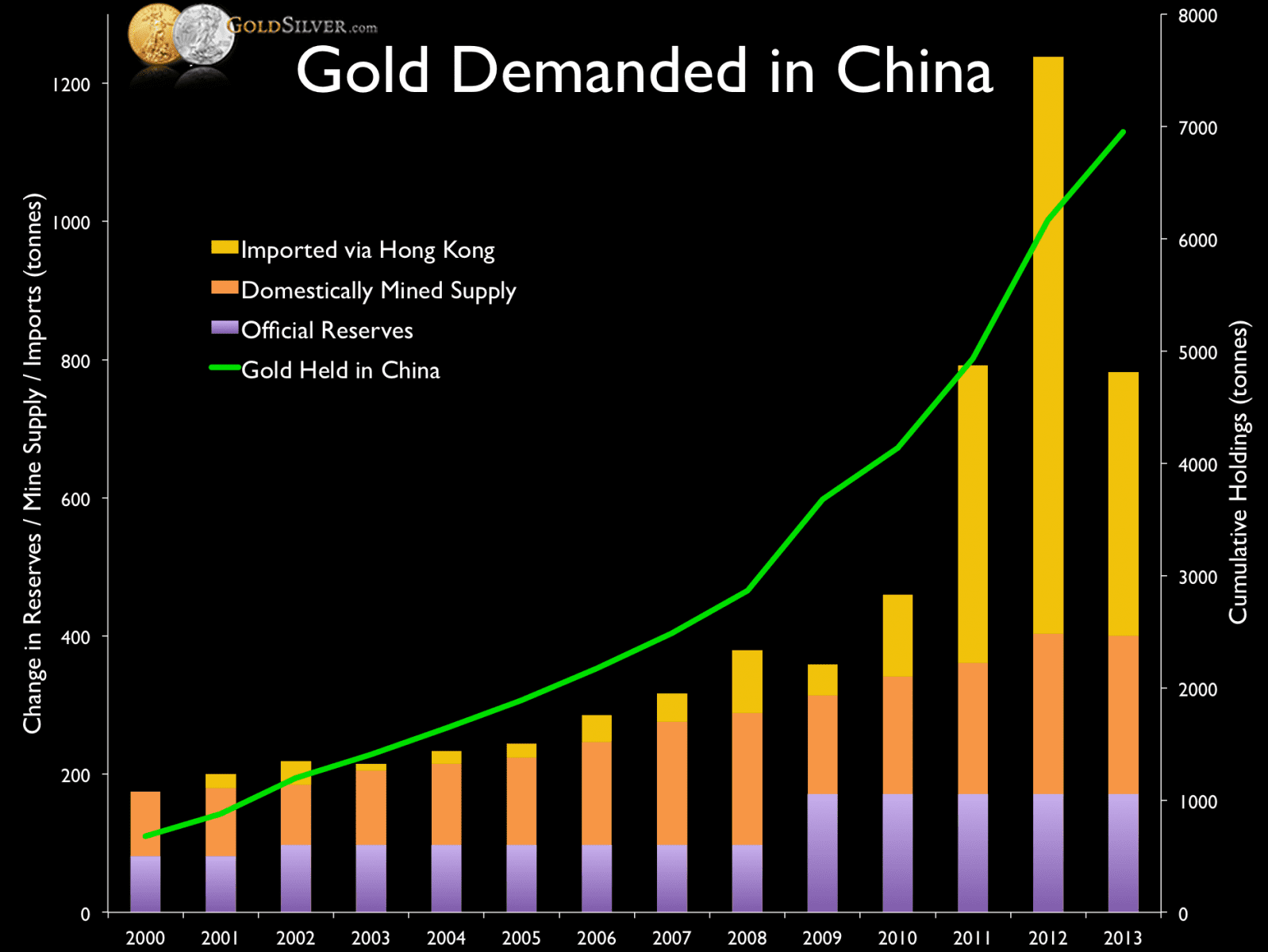

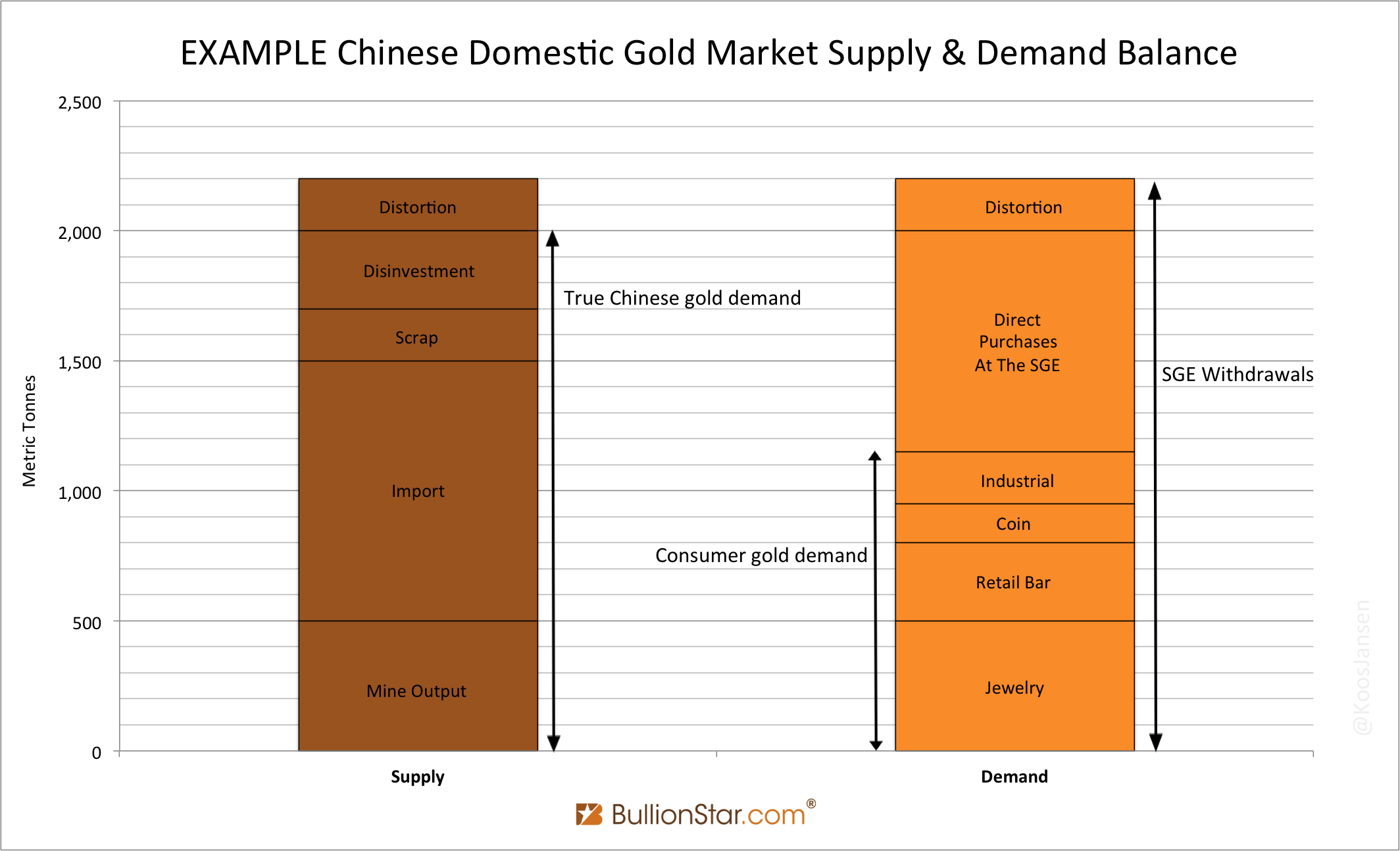

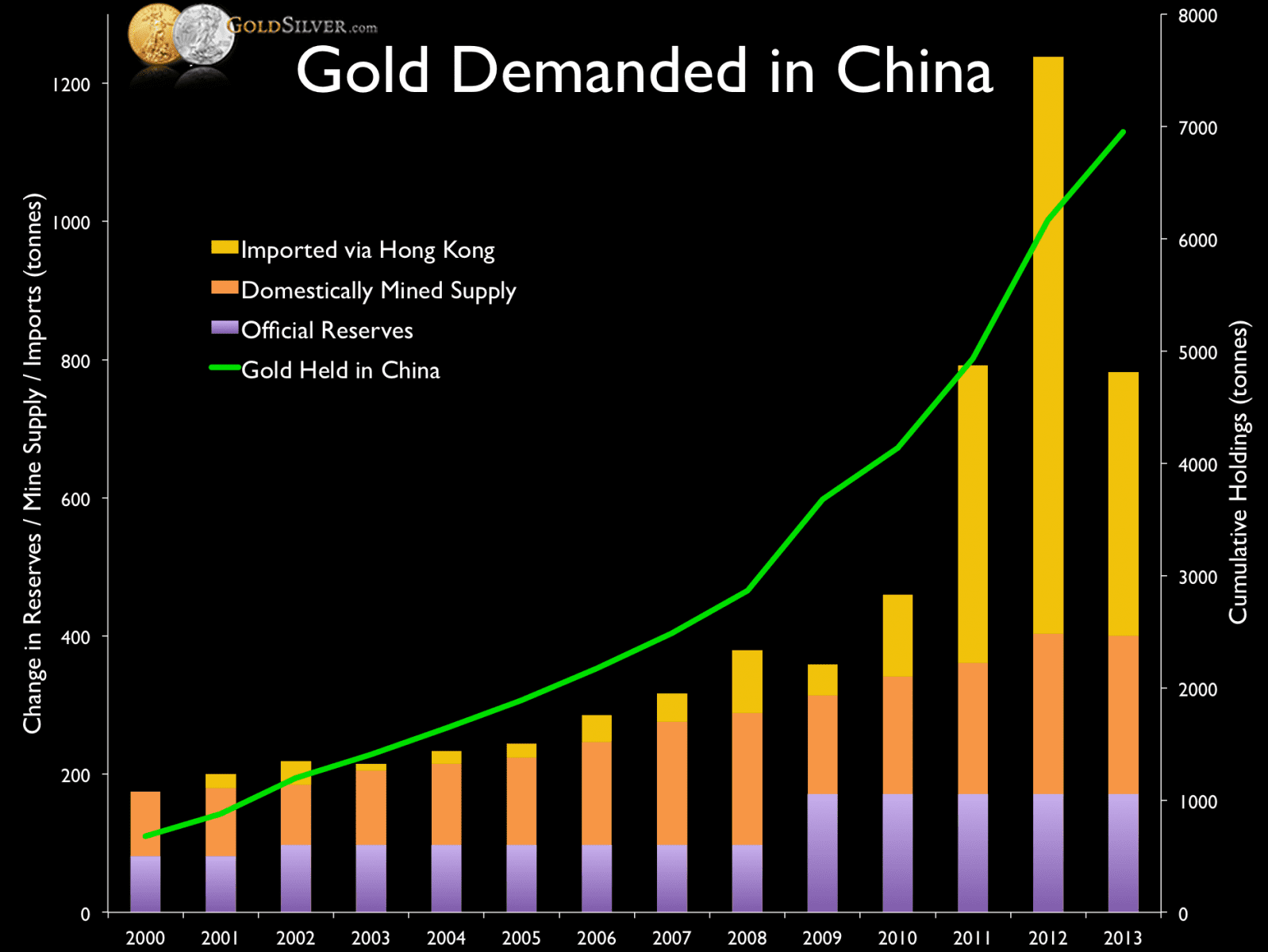

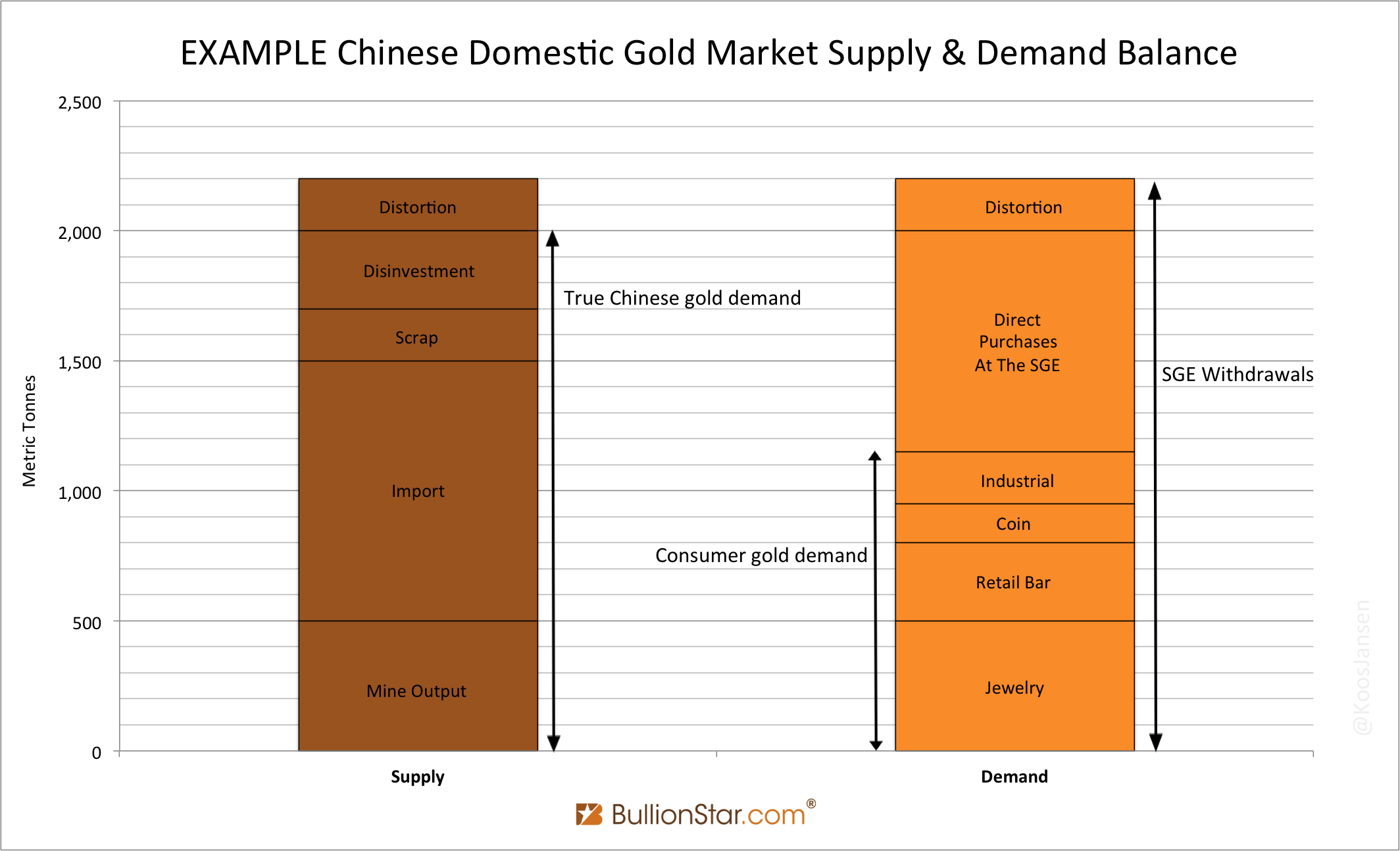

Looking at the average Shanghai premium over the entire period (4134 daily observations from 2002 to 2019), a “Chinese New Year” effect seems discernible, as the three months with the highest average premium fall just before and during Chinese New Year: December stands at $5.71 /oz, January at $7.45 and February at $5.93. Source: Batar Group Higher physical gold demand before Chinese New Year. Led by such tradition, December – approximately one month before the CNY – has been a better month for gold retailers historically. 2 According to the National Bureau of Statistics, monthly retail gold sales, including gold bars, coins and jewellery, have on average been highest in December every year during the past After an impressive start to the year, Chinese gold demand was relatively soft from February onwards. Banks, refiners and jewellery manufacturers withdrew a combined 1,455t of gold from the SGE, 15% less than in 2023 and 22% lower than the 10-year average (Chart 3). The celebration is so important that the consumption of gold in the first quarter of each year increases, on average, by 14% compared to the previous quarter. China hosts about 17% of the global population and is the largest gold market in the world. The demand for gold in the Land of the Red Dragon accounts for 28% of annual global gold demand During the first month of 2024, wholesale gold demand in China jumped ahead of the Chinese New Year’s holiday in mid-February, recording the strongest January ever and lifting the local gold price premium. Meanwhile, the PBoC stretched their gold buying spree to 15 months and gold ETFs in the region once again attracted inflows. Post by Ray Jia During the annual Chinese New Year period, factors such as market closures during the holiday, changes in consumer buying demand, and promotional activities by merchants typically lead to fluctuations in China’s gold market. Regarding the gold market’s performance during this year’s Chinese In another sign of improving Chinese gold demand, the Shanghai-London price spread turned positive toward the end of the month. Anecdotally, the World Gold Council reported that Chinese jewelry wholesalers and manufacturers said showrooms were busier in December and retailers stocked up for an anticipated sales boom to kick off the new year The Chinese gold market showed seasonal strength in December, but wholesale demand finished the year below the 10-year average. Total gold withdrawals from the Shanghai Gold Exchange, a gauge for wholesale demand, rose by 24 percent month-on-month in December. Withdrawals totaled 122 tons. In A similar pattern can be observed in the monthly gold withdrawals from the Shanghai Gold Exchange (SGE). Meeting the demand for the Chinese New Year, January 2024 saw the largest ever load-out of 271 tons. Withdrawals, however, flattened and continued shrinking in the following months, with May, June and July figures all below 90 tons. The Chinese gold market showed seasonal strength in December, but wholesale demand finished the year below the 10-year average. Total gold withdrawals from the Shanghai Gold Exchange, a gauge for wholesale demand, rose by 24 percent month-on-month in December. Withdrawals totaled 122 tons. In another sign that Chinese gold demand is on the rebound, gold exports from Switzerland rose in November. Analysts say increasing demand from China, as well as India, accounted for the increase. Gold also began selling at a premium in China as 2024 came to an end. The drop in gold global prices coincides with the runup to the Chinese New Year on Jan. 29. “It is possible that Chinese investors are seeing the recent dip in prices as a ‘less risky’ time to buy. As demand recovers, so does the price premium,” Donohoe said. The drop in gold global prices coincides with the runup to the Chinese New Year on Jan. 29. “ It is possible that Chinese investors are seeing the recent dip in prices as a ‘less risky’ time to buy. An overview of China’s gold jewellery market. China’s gold jewellery consumption has been weakening so far in 2024. As mentioned in our Gold Demand Trends report, after a strong start in January and February – the traditional sales boost around the Chinese New Year holiday – gold jewellery demand went off a cliff. China’s gold market review: a divided 2024. The local gold price in China has experienced a record-smashing year so far in 2024. The RMB gold price – represented by the Shanghai Gold Exchange (SGE) Au9999 – had surged by 28% as of November end, making it the best performing asset in China so far this year – and its international peer in USD also saw a similar rise. Although barely half the Shanghai gold premium's long-term average, Friday's figure contrasts with an average Chinese discount equal to almost $14 per ounce so far this calendar quarter, as China's private sector gold demand weakened further in the face of new all-time record gold prices, now averaging $2666 per ounce since the start of October. 4. Commodity prices finds seasonal Chinese New Year fluctuations. China is the biggest producer and consumer of gold in the world, and Chinese New Year pushes demand up, as people look to give gold and jewellery as gifts. The influence this has on gold prices early on in the calendar year is notable. Finally, Chinese traditions consider 2024 a less auspicious year to get married, and this could result in lower-than-expected gold jewellery wedding demand. Gold bar and coin demand should remain solid this year, although sales may not repeat the 28% growth surge of 2023 . Support from potentially lower interest rates may offset slower economic Gold discounts in India remained stable due to high prices deterring buyers, further exacerbated by the rupee's depreciation. In contrast, Chinese dealers raised premiums anticipating increased demand before the New Year. While Indian demand slackened, Chinese investment demand was expected to increase, buoying the market despite sluggish jewelry sales. The “stay put” initiative and booming Chinese consumption during the holiday. China’s retail consumption during the 2021 Chinese New Year (CNY) holiday surged as people in major cities were encouraged to “stay put” for the festival to strengthen the COVID-19 containment. 1 According to data published by the Ministry of Commerce, key retail and catering revenues in China during the

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

| |

|  |